.png?width=2000&height=633&name=30x30%20Blog%20Header%201%20(2).png)

June 25, 2025

Imagine it's the year 2030. Drones are delivering your morning newspaper, you’re traveling by hyper-loop to the 48th Payroll Congress and the New York Jets are still searching for a quarterback. What is your vision for payroll in 2030? What do you want to see change? What do you want to be doing on the job?

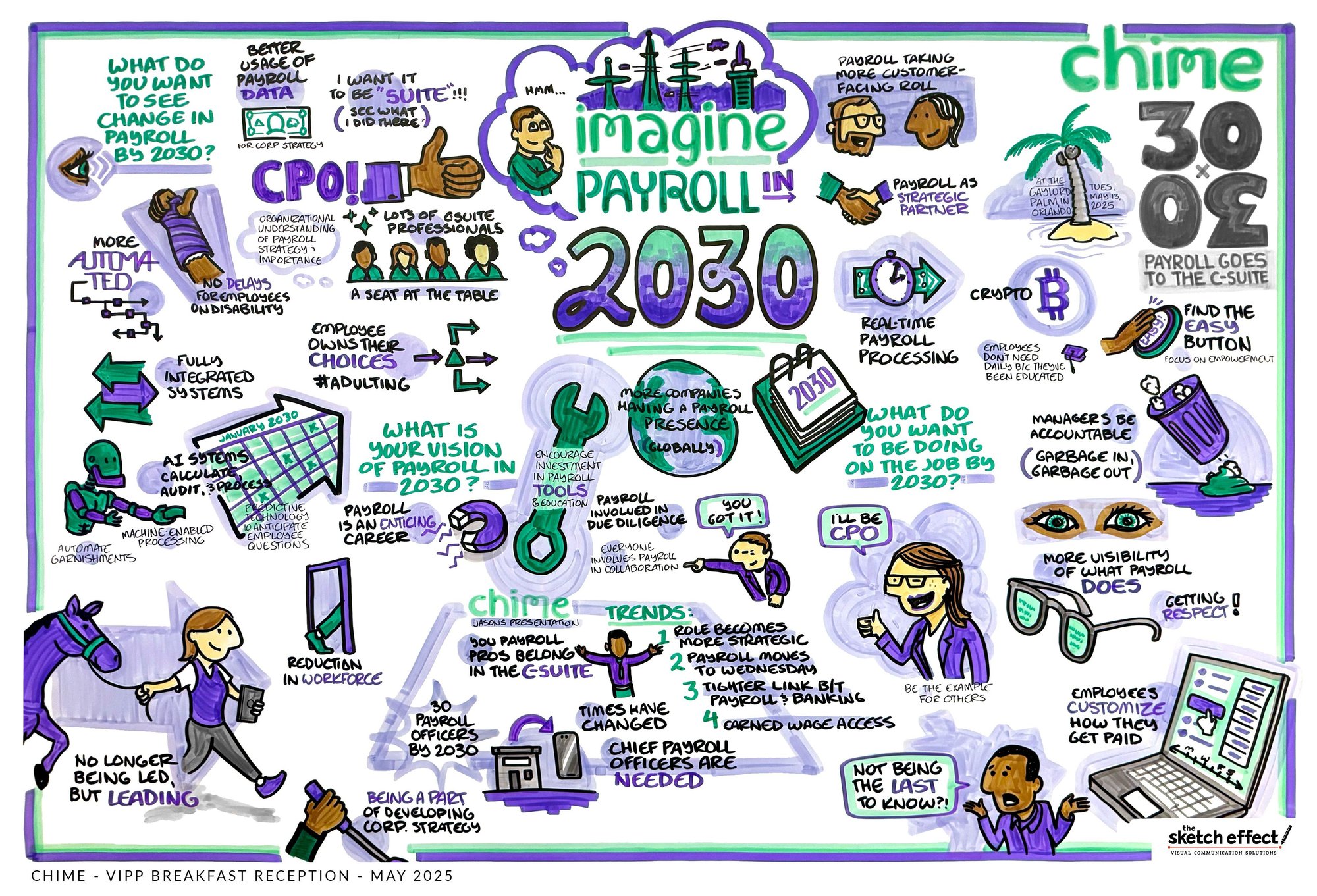

We asked 30x30 members those three questions at our VIPP breakfast during the recent Payroll Congress and we were blown away by the responses (see image).

Why do we need a payroll vision for 2030? Because as the great Yogi Bearra opined: “if you don’t know where you’re going, you’ll end up someplace else.” So without further ado, here is our vision of payroll in 2030, incorporating your great feedback.

- Wednesday will be the new Friday

Imagine everyone gets paid as soon as you run payroll. No more wondering whether the ACH files cleared. No more calls from grumpy employees asking where their paychecks are. Does this sound too good to be true? It’s not. According to the Federal Reserve, payroll is the fastest growing use case for instant payments. It’s one of the reasons the central bank introduced the FedNow service in 2023, following in the footsteps of real-time payments (RTP). Concerns over fraud, security and reversibility are some of the exact same concerns that were raised when direct deposit launched in 1974 and we know how that story ended.

Perhaps, the surest sign that instant payroll is coming is the proliferation of early direct deposit, one of the most popular and successful consumer banking innovations since the rise of online banking. When Chime introduced it in 2015, it was a niche service that was not widely available. Now it is one of the fastest growing banking tools, available at 9 of the largest 25 banks. Like it or not, consumer demand drives technology adoption and consumers are voting with their feet for faster direct deposits, which brings us to our next topic. - Payroll and banking will tie the knot

An invisible wall exists between the payroll and banking worlds, creating stress for employers and employees. Payroll departments don’t know when paychecks are received. Workers juggle multiple finance apps to help them make it to payday, often failing to save any of their hard earned money. Why can’t payroll and banking talk to each other? They will. Actually, it’s already started here at Chime where we just launched PayTV, short for Transparency & Visibility, enabling payroll pros to track when funds arrive, resolve issues faster and respond to inquiries with confidence.

That is just the first step. Our vision is that banks and payroll will be fully integrated, communicating in real time, delivering a better pay experience for employees and payroll professionals. Payroll files will be scanned for anomalies before they hit the rails. Workers will have access to financial tools embedded in payroll to help them spend smartly, save automatically, and build credit responsibly, all before payday. The first phase of payroll embedded finance is earned wage access. Speaking of which… - EWA 2.0 will be user friendly for workers and payroll

Earned wage access has been one of the most sought after benefits for everyday workers, helping them avoid late fees and payday loans. Employers have increasingly offered it to boost recruiting, engagement and retention. And yet, the first generation of EWA products could use a major upgrade. How so?

First, EWA should act as a bridge to better financial health, not a destination in itself. Some workers use it responsibly, while others get caught in the cycle of earned wage excess. What they need are financial tools that help them graduate from EWA so they can not just survive but thrive. Second, fees need to come down. Way down. Point solution vendors that rely on high instant fees should be increasingly displaced by financial institutions offering EWA at a low or no cost to attract direct deposits. And third, EWA should not interfere with the payroll process, either through a wage deduction or a payroll intercept. Compliance matters. This is our approach at Chime. - Automation will be across the board

30x30 members envision more automation across payroll functions. Real-time payroll processing. Fully integrated systems. Machine-enabled calculations and audits. Predictive technology to anticipate employee questions. Automated garnishments. You get the picture.

So does this mean you can finally just push that magic payroll button and put your feet on the desk? Not quite. These automated tools will free you up from the more mundane tasks so you can focus on driving strategic outcomes. - Payroll will be a strategic partner

These technology innovations - instant payments, embedded banking tools, user-friendly EWA and fully automated payroll - will enable payroll to drive value across the organization. Faster payments will reduce employee complaints, driving higher productivity for Operations. Payroll banking tools will deliver employee financial wellness, a top priority for HR. The next generation EWA program will be the compliance gold standard that Legal will value. And a more automated payroll process will deliver ROI and cost savings for Finance. This is how the right technology solutions can quickly make payroll a strategic partner of choice across the organization.

And it doesn’t stop there. One 30x30 member sees payroll data driving strategy. Another sees companies better understanding payroll’s strategic importance. A third sees payroll getting involved in due diligence. A fourth sees payroll professionals actively developing corporate strategy. Yes, yes, yes and yes! - Payroll will be a career path

“Payroll is an enticing career” made it onto the 30x30 vision board and we agree! In fact, this is what 30x30 is all about. As awareness of payroll’s strategic value builds, so will the value of payroll career. In addition, payroll professionals will acquire valuable business skills as they collaborate with Finance on planning, Operations on staffing, Legal on compliance, IT on security and HR on compensation. That is how a payroll expert becomes a business expert, opening up an array of career opportunities in the process.

Before the CFO position existed, many viewed the finance department as a back office bookkeeping realm where career advancement was limited. Now it’s one of the most common paths to becoming CEO. Likewise, the rise of the Chief Payroll Officer will make payroll a launching pad.

These are more than predictions; they are a collective vision of how payroll will drive strategic value. Together, let’s make it happen.

Turn paychecks into progress™

Ready to learn more about how Chime Workplace has built tools to make payroll easier, more satisfying, and a lot less stressful? Sign up here and we'll keep you in the loop.